Medicare Part A & B

Enrolling more than 3 months past 65th birthday

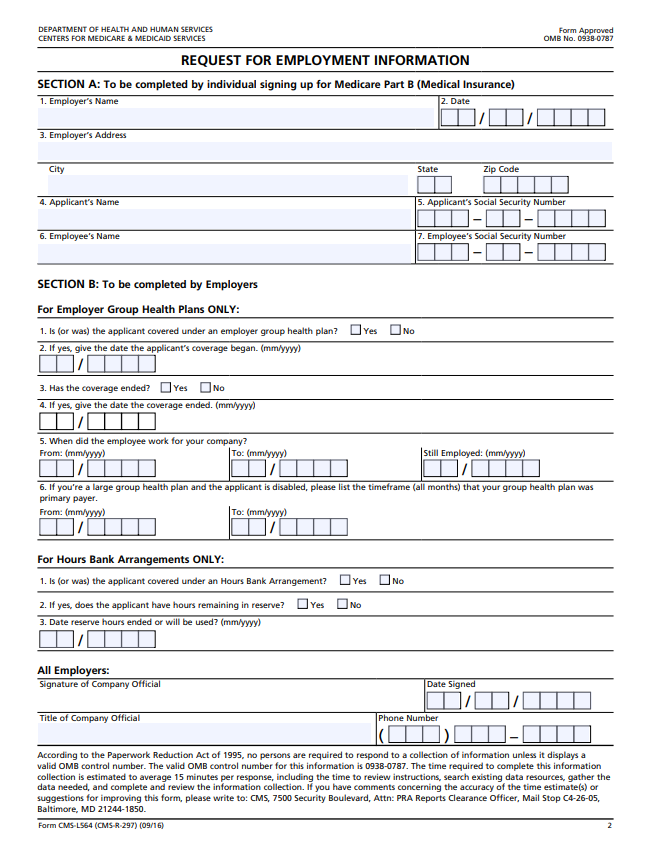

Since you did not enroll in Parts A & B when you first became eligible, you will have to submit documentation to show you had creditable coverage from your 65th birthday. You will need the Request for Employment Information to apply.

- Send this to your employer first for completion. See more information below about completing this form.

- Once you receive the completed copy back from your employer, you can apply for Medicare.

Do you need your Medicare number, but haven’t received your ID Card yet?

If you do not receive your ID card, please contact HTA and we can help you find your Medicare number online. You can also look for it yourself by logging into www.ssa.gov, but can be tricky to find. Here is are some screen shots to show you what to look for when trying to find your Medicare number online.

More information on the Request For Employment Information

This form is necessary to show you have a valid enrollment period and to avoid a Medicare Part B late enrollment penalty.

- Please take this form to the Human Resources Department to complete.

- You will need a form completed for each spouse that wishes to apply for Medicare.

- The form confirms you have had creditable coverage since you turned age 65, which will show that you are eligible for enrollment; as well as, waive a late enrollment penalty.

Creditable coverage is verified on the form by:

- The dates the Employee was Actively Employed.

- The date you were covered under the Group Health Plan.

- The start date should reflect the initial enrollment in group coverage NOT the date of your last enrollment period.

If you have not been covered under the same employer since you turned age 65, you will need an Employment Verification Form from each employer that provided you group coverage.

- If your employer is out of business or unable to sign this form, other acceptable verifying documents may be accepted. Contact HTA if you need a list of other acceptable types of documentation.